Global Capital Flows 2022

As of 10 November 2022, the UK tech sector saw venture capital (VC) investments totalling $21.96bn year-to-date. While this figure extrapolated to the full year does not come close to the $32.69bn raised in 2021, it is substantially higher than the $14.61bn raised in 2020. It is worthy to note that 2021 was a record year for UK tech investment, having come out of the global pandemic.

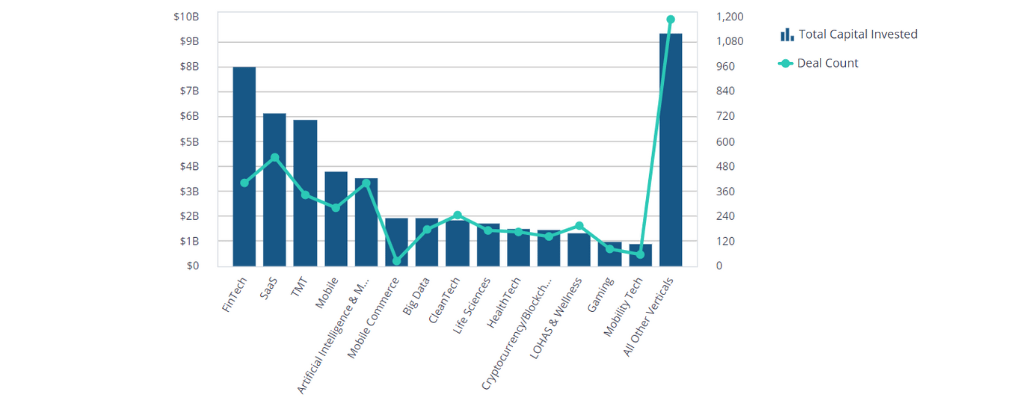

The three verticals that received the most VC funding are financial technology, software-as-a-service (SaaS), as well as technology, media and telecommunications (TMT). The fintech start-ups in the City of London has attracted investments from big names such as Franklin Templeton, GIC, Qatar Investment Authority and Tiger Global, while the biggest funding round of $1bn was closed by SaaS business Checkout.com.

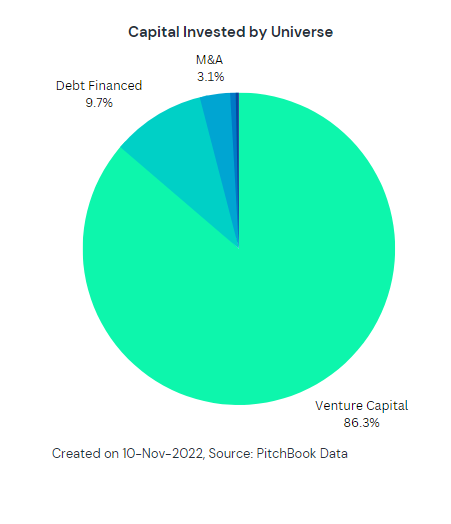

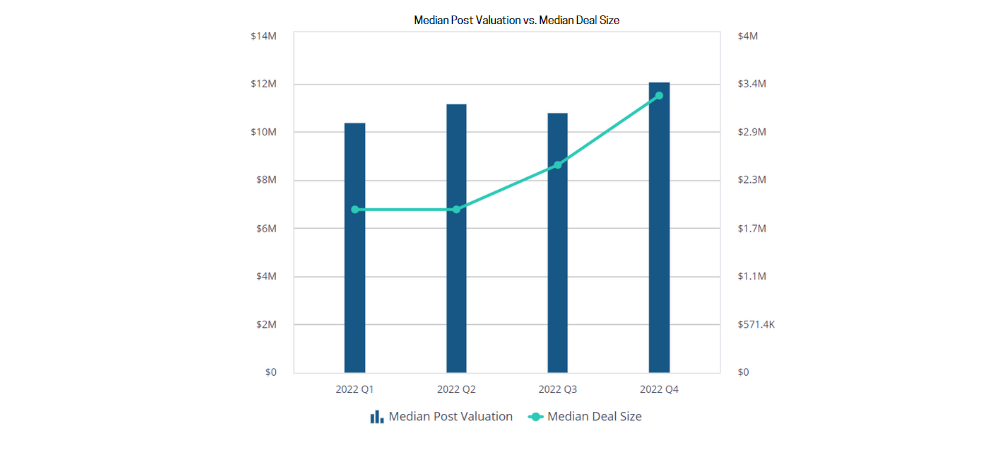

VC funding continues to dominate the UK tech capital universe, contributing to 86.28% of total capital invested in the sector. For YTD 2022, the sector has seen 2,030 VC funding rounds for 1,893 companies. The median post funding valuation is $11.32mn, which has been steadily increasing throughout the year to reach $12.50mn by Q4. Similarly, the median deal size has increased from $2.03mn in Q1 to $3.68mn in Q4. The most active investor by deal count is Innovate UK, which is a government-funded research and innovation agency. It has made 61 investments this year alone, with the latest having closed on 1 November.

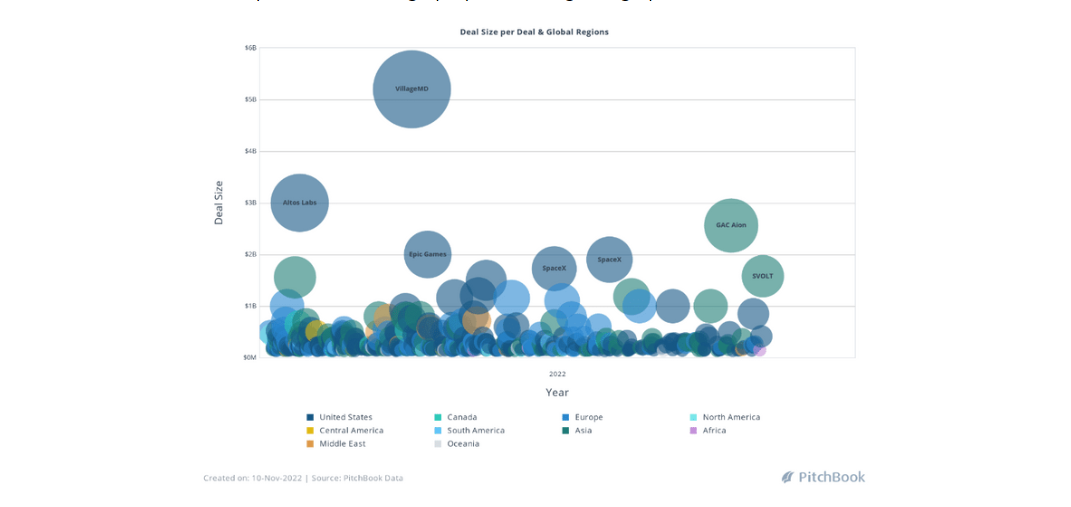

Taking a more global view, Europe has a 18.70% share of the global venture capital pool, which is dominated by the United States with a 49.44% share. Asia, which also precedes Europe, comes in at 22.39%.

Within Europe, the UK leads with 28.49% of total funding, followed by France and Germany. Compared to a year ago, the UK’s share of European-based investments has fallen from 30.79%, although Europe’s share of global capital has increased from 15.08%. This could be potentially problematic if we are seeing only the start of a trend of investments moving away from the UK towards members of the European Economic Community post-Brexit. However, the silver lining may lie in a refocus of British investors towards domestic businesses, which will alleviate the problem of foreign players owning a large part of UK tech firms.

Funding rounds above $1bn are saturated in the US, with a handful in Europe leading up to mid-year and a couple in Asia going into Q4. Most of the deal sizes are within the $0-250mn range, which is traditionally the sweet spot for VC funding in the tech sector, especially in the earlier funding stages. The biggest funding rounds are also going to verticals which are most capital-intensive, including health tech, fin tech and space tech. It is observed that the capital intensity of verticals, or more specifically the nature of business, matters more than other factors such as funding stage when it comes to analysing funding sizes. GAC Aion, China’s most valuable EV company, raised a staggering $2.56bn in its Series A round.

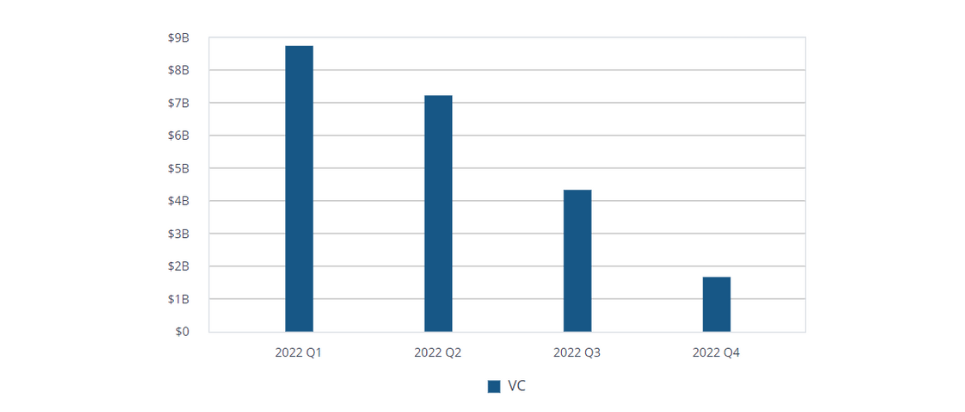

In line with global VC trends, the amount of capital invested in the global tech sector has been falling quarter after quarter this year. There was $153.44bn of dry powder deployed into the sector in Q1, but only $81.21bn in Q3 and potentially less in Q4. Given that record funds were raised by VCs in 2021 and into 2022, it is expected that the current build-up of dry powder will translate into new investment pressures and opportunities going into 2023. It is up to different governments and their investment policies to capture as much of the international capital pool as they deem fit. In particular, the UK has been on the forefront of tech investment growth since the unveiling of its first Digital Strategy in 2017. As part of the UK government’s push to close the digital skills gap in its workforce, a new Digital Skills Council has been formed to establish a working relationship between industry leaders and business owners. This is likely encouraging news for tech investors who want in on the next profitable idea backed by motivated and skilled founders and employees alike.

Accounting for 37% of UK tech sector investment, US investors are key to the present and future growth of the sector. At the Global Emerging Technology Summit in September this year, there was discussion of a potential government review of outbound investment from the U.S. for the first time. This review is also termed “reverse CFIUS”, CFIUS standing for Committee on Foreign Investment in the United States. Embraced by the National Critical Capabilities Defense Act of 2022, it mandates scrutiny of US investments in countries “of concern”, which include China, Russia, North Korea, Iran and more. While it is a surprise move, it may potentially work in favour of the UK, given that it is not part of the list of countries “of concern” and may receive more investment capital from its biggest investment source. According to the Commerce Department’s Bureau of Economic Analysis, American companies have invested over $118bn in China, or around 1.8% of all US foreign direct investments.

There are lessons to be learned from the post-pandemic era of sky-high valuations and explosive venture capital funding. It was a period when start-ups stayed private for longer than they traditionally did, kept afloat by private money rather than public ownership.

Softbank’s Vision fund ploughed $100bn into the VC market, which has since registered a loss of $27bn earlier this year. Many funds which invested at the peak of the market may see negative portfolio returns at a scale and extent unseen even during the dotcom crash. If the falling valuations and crashing stock prices of tech start-ups and publicly traded companies exhibit a contagion effect and affect traditional verticals including software and semiconductor manufacturers, then it is likely that an exodus of VC funding will take place in the tech sector and flow to other industries.

Now, capital is expected to flow to only the most well-proven and non-cyclical businesses. SpaceX is a perfect example. Having raised $250mn just in July, it has a post-money valuation of $127bn, which over a year ago would have been matched by ByteDance, Stripe and Uber. Businesses like SpaceX can continue to raise money on favourable terms. On the other hand, overvalued start-ups who are now left exposed have no choice but to tighten their purse strings and maximise the time that their outstanding cash balances can last their business. Klarna, for instance, closed their latest funding round on unfavourable terms in order to fund their expansion into the US market. The business was last valued at $5.9bn in July, down from $45.6bn in 2021.

This trend is evident in aggregate data, which reveals a fall in deal count and total capital raised throughout the year, but an uptick in median deal size and post-money valuation. Once again, businesses with a sound business model and prudent financial management are closing bigger venture funding rounds amidst a period of cautious investment sentiment.

To have a sense of how things will be in 2023, we have to internalise the current market for venture capital. The bifurcation of (potentially) profitable and unprofitable businesses in their quest for new money will further the divide between their growth rates and profitability margins, provided that capital continues to be well deployed.

Asian markets are expected to remain tamed as businesses continue to be suppressed by Covid-19 restrictions and travel bans. As of 2 November, China stays committed to their ‘zero-Covid’ policy, while the likes of Indonesia, Myanmar and Bangladesh mandate quarantine for vaccinated travellers who test positive.

Aligned with our bifurcation thesis, Goldman Sachs bankers are predicting a pick up in mergers and acquisitions (M&A) in the private tech sector. Ryan Nolan, global co-head of software banking said, “We have had a very busy year on the public side of [M&A]. The private side of that is ready to come, and that’s where we’re set up for 2023.”

The above is an extract from our Financial Report: Technology Industry 2022, to download the report click here!

Camino Search partners with some of the most impressive PE funded, tech and tech enabled businesses, connecting them with exceptional finance professionals.

Check out our Salary Benchmarking documents, or our Client Brochure. And get in touch with one of our consultants if you want to hear more!