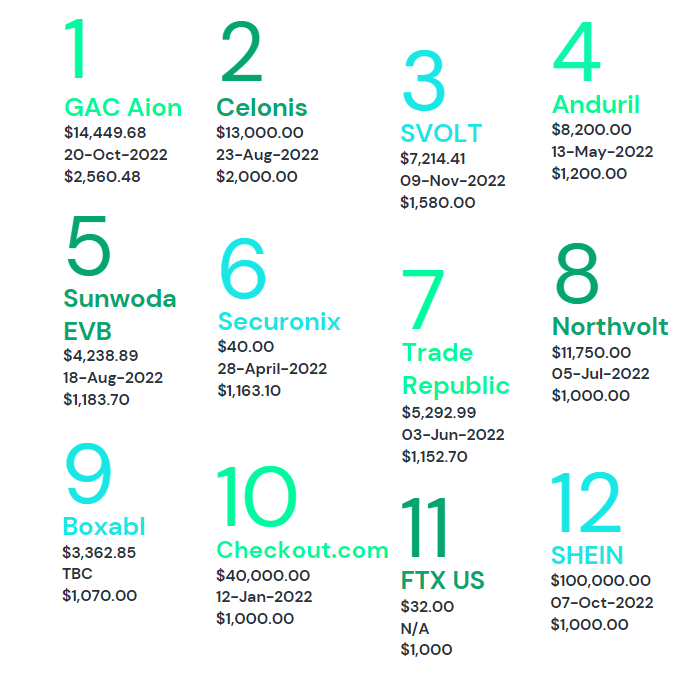

Top Investments from 2022

The list of the top 20 VC investments in global tech by deal size smaller in comparison to that from last year, but largely stay within the billion-dollar range. Below you can see the top 20, alongside their last known valuation, last known financing date and last known financing size.

There are several familiar names in this list, including Chinese GAC Group’s electric vehicle subsidiary GAC Aion, Chinese fashion powerhouse SHEIN, and Swedish buy-now-pay-later pioneer Klarna.

Boxabl, which is a manufacturer of modular houses capable of being mass-produced and shipped, is looking to raise a total of $1.07bn in the form of $500mn Reg D equity, $500mn debt and $70mn Reg A+ equity. The lowest investment tier starts at a commitment of just $10,000 priced at $0.76 per share, which goes down to just $0.60 per share for investments of $100mn and above. Having completed delivery of an initial order of 156 houses by the U.S. military, the company is working towards serving over 100,000 reservations for the Boxabl Casita, their flagship accessory dwelling unit. With over $1bn in potential revenue, Boxabl has recently announced the opening of their second factory sitting on a 133,000 square feet plot of land in Las Vegas, Nevada. The company has also announced its intention to go public in the future.

A few entities on the list have undergone radical changes since their latest funding rounds. FTX filed for US bankruptcy protection in the U.S. on 11 November, following a series of events that led to a liquidity shortfall. Temasek, the investment firm owned by Singapore’s government, has written down its full investment of $210mn in FTX International, which represented a minority stake of 1%. Sequoia Capital, known for its early backing of Apple and Google, issued an apology to its fund investors for the $150mn lost on FTX. Sequoia’s partners reassured investors that the business will improve due diligence on future investments.

On the other hand, Getir has been leveraging on the funds it raised to gain control of competitors in the on-demand delivery sector. In November 2021, UK-based grocery delivery startup Weezy was acquired by Getir, having only raised a pre-seed round a year prior. In October this year, Getir announced that it is in talks to acquire Gorillas, at a time when both businesses are facing headwinds and reducing headcounts. The deal is subject to further due diligence as the sector shifts from a hyper growth thesis to one more focused on a path to profitability.

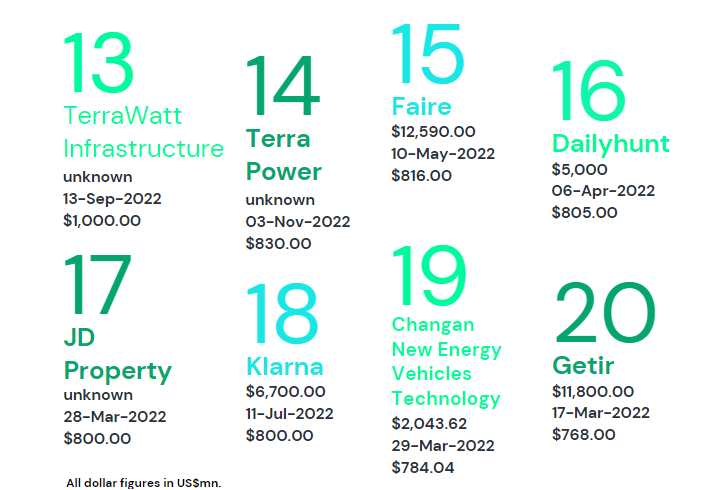

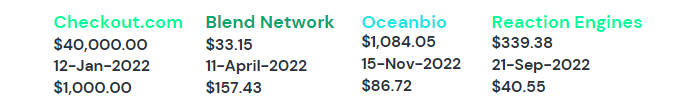

The top VC investments in UK tech by deal size are concentrated in the <$100mn range. The portfolio of UK-headquartered companies specialises in computing tech, medical tech, and environmental tech. Checkout.com is the only billion-dollar fundraiser.

Checkout.com is the developer and operator of an online payment platform with end-to-end payment technology. In January, the company raised $1bn of Series D funding from Endeavor Catalyst, Coatue Management, and Dragoneer Investment Group amongst others. Part of the funds will be used to expand the team and onboard new clients in the e-commerce and physical retail space. The post-money valuation stands at $40bn, which is a stark increas

e from the $15bn valuation in Series C just a year earlier. The high valuations may be because the company has been profitable for several years and is only at the start of its growth journey as it shifts its focus to the U.S. market and stays committed to large multinational enterprise merchants with a steady transaction volume.

A particularly interesting business is that of Cambridge Medical Technologies, which develops bloodless blood tests by using a chip-based band-aid to collect clinical-grade readings of blood biomarkers. Headquartered in Cambridgeshire, UK, the company has raised $15.52mn to date, with the latest round totalling $6.99mn and bringing its post-money valuation to $59.87mn.

The Asian tech VC investments are sized a notch above the UK and are dominated by transport and automobile tech companies.

As shown earlier, the largest funding round raised by YTD was on October 20 by GAC Aion. GAC Aion raised $2.56bn at a post-money valuation of $14.45bn for R&D, product development, and mass-production technology for new-generation batteries and electric drive systems. It may not be a coincidence that second place goes to Sunwoda, a Chinese provider of electric vehicle battery pack solutions. The company raised $1.18bn in August, at a post-money valuation of $4.44bn. The funds will go towards lithium battery capacity construction and product iteration. Such investments will be key to overcome the biggest hurdles faced by the electric vehicle industry, such as long charge times and low full-charge mileages.

XPeng AeroHT takes electric vehicles a step further, by developing and manufacturing hybrid flying cars meant for both road and air. The business received $830.81mn of debt funding from Shanghai Pudong Development Bank, China Construction Bank, China CITIC Bank and Agricultural Bank of China on November 8. An undisclosed amount of Series A+ funding was raised previously, with participation from Rockets Capital.

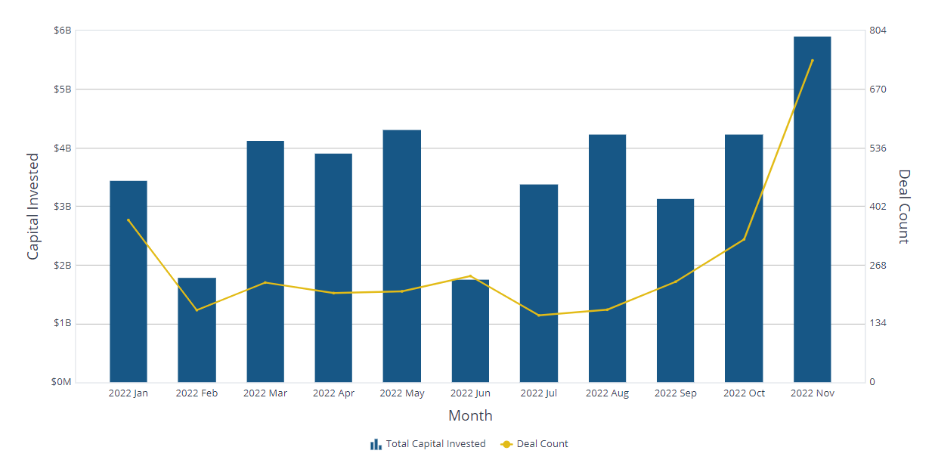

Total VC funding in the sector has seen cyclical fluctuations throughout the year but maintained a modest growth of over $1bn from January to November. Deal count, on the other hand, was stable until it shot up in the month of November to reach 361, with a week left to the total count. For comparison, the month of October saw 82 deals.

The sharp rise in the number of deals may be attributed to the growth of early stage and seed rounds raised in November. Such a trend may be in line with the heightened investor caution we see in the market, placing a limit on big and risky bets while shifting some of that dry powder into early-stage and smaller funding rounds.

Sources

https://my.pitchbook.com/search-results/s225975281/deals

https://invest.boxabl.com/invest/regd-offering-2

https://www.wsj.com/articles/sequoia-capital-apologizes-to-limited-partners-for-ftx-investment-11669144914

https://www.temasek.com.sg/en/news-and-resources/news-room/statements/2022/statement-FTX

https://techcrunch.com/2021/11/23/getir-weezy-acquisition/

https://www.uktech.news/mobility/getir-to-acquire-gorillas-20221011

https://my.pitchbook.com/search-results/s225975281/companies

https://techcrunch.com/2022/01/12/checkout-com-raises-1b-round-at-40b-valuation/

https://www.forbes.com/sites/davidprosser/2020/07/22/meet-the-healthcare-entrepreneur-set-to-revolutionize-blood-testing/?sh=3218dea552a7