Financial Report : Q1 2023 - Chapter 1: Global Capital Flows

The UK Tech industry got off to a rocky start in 2023, with rising interest rates and peak inflation casting shadows over investor appetite. In 479 venture capital (VC) deals with a combined capital raise of $3.59bn, the figures fall short of the $12.2bn raised in Q1 2022.

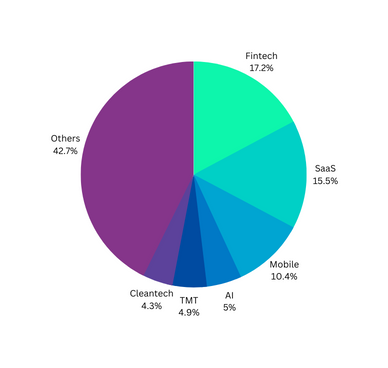

Figure 1: Capital Invested by Verticals

(Created on 4th May 2023 - Source: PitchBook Data)

The vertical that raised the most funding in this quarter is financial technology, or fintech. The biggest fundraising round goes to Abound, which is a provider of consumer lending services to customers with limited access to traditional credit. Investors including GSR Ventures, Hambro Perks and K3 Ventures raised a total of $600mn. Looking at the total capital invested, later stage VC took a big share of the pie in January with close to 70% of the total VC funding going to Series C, D and so on. However, this took a turn by the end of the quarter, as early-stage VC overtook late-stage VC in funding received.

The largest investor in this quarter is SFC Capital, a VC firm based in London that is founded in 2012. Being a sector-agnostic investor, SFC Capital has made 25 investments in the first quarter alone across businesses in the seed-stage all the way to growth-stage. The firm is currently raising its SFC Angel Fund XIV and XII as part of its public push for funds in the range of $5-20mn.

Figure 2

.png)

With reference to Figure 2, deal count and post-deal valuation saw a slight dip from January to February, in part due to the turmoil facing the financial industry especially pertaining to small regional banks and neo banks. While deal count surpassed January levels

in March, investors remained vigilant as the financial industry picks up its steps from the fall of Silicon Valley bank and UBS’ acquisition of Credit Suisse.

The overall picture, however, is clear. The era of cheap capital as seen in 2022 is over, and tech start-ups are finding themselves trimming costs to maximise the life of capital raised in prior years. As Jed Rose, partner at Antler VC sums it up, “the UK’s fintech ecosystem will retain its position as one of the global leaders for creating and growing exciting startups which are driving innovation.” For this year, the sector is expected to work around the evolving demands of consumers and businesses alike, with the most success going to startups which can navigate the cost-of-living crisis and extract value in the areas of debt repayment, mortgage refinancing, and tax support.

In the overall tech industry, layoffs are expected to persist and sectors such as B2C will be particularly hard-hit. According to Jay WIlson, Investment Director at AlbionVC, “it is expected that investors will have a flight to quality with an increased focus on the price and terms of fundraising rounds”.

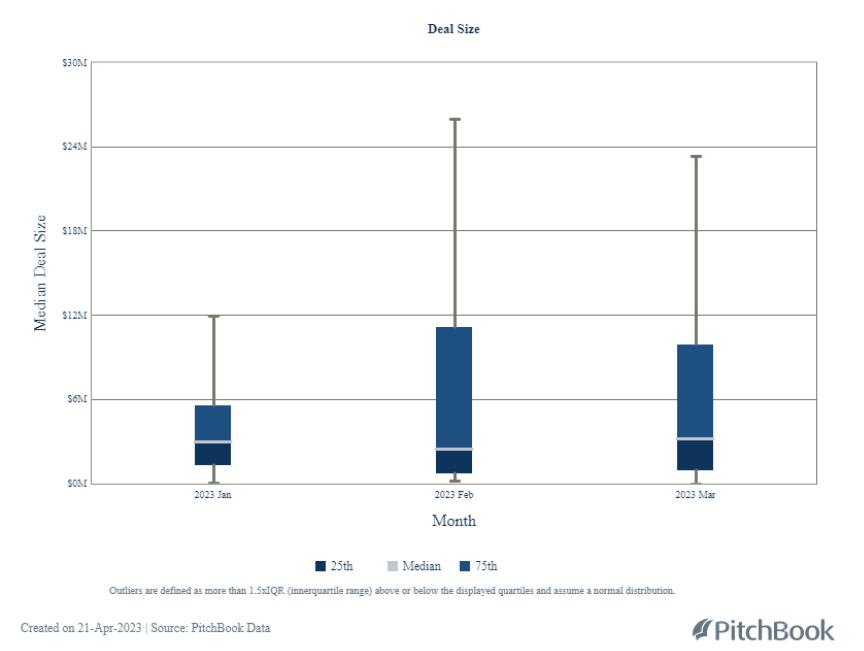

Figure 3: Deal size variation

Big fundraising rounds above $10mn are the outliers, with majority of deals in the $2-4mn range. While deal sizes have increased from January levels, we expect figures to remain tamed as investors remain vigilant and do not feel a need to deploy dry powder within a short timeframe.

Download the full report, here: